The best people are Rare

FINDING AND DEVELOPING THE UK’S BEST EARLY TALENT FOR 20 YEARS

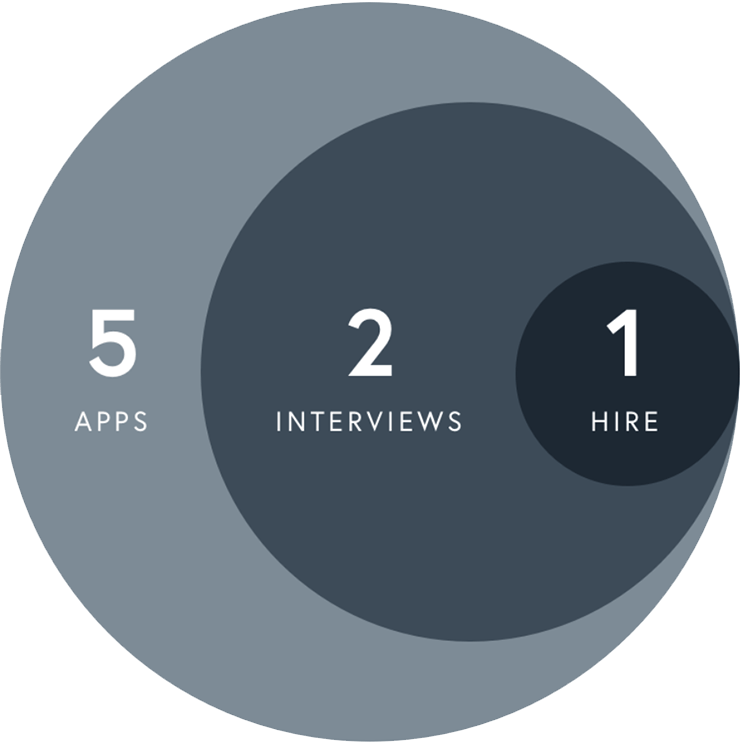

Our clients include some of the most prestigious employers and universities in the world. Our candidates are among the most impressive early talent you will meet.

We help our candidates show their full potential through one-to-one development, expert advice and exclusive events. We help our clients hire and retain the best early talent from every background.

WE DON’T JUST IDENTIFY TALENT, WE DEVELOP IT.

Looking for Rare Technology?

For information on Candid, CRS, Vantage and Hemisphere, please visit the Rare Technology website.

Continue